Berkshire Hathaway HomeServices Georgia Properties

Real Estate Advisor – December 2016

We wish you a Merry Christmas, Happy Hanukkah and Happy Holiday. Enjoy time with your family and friends and be safe during the holiday season. This is a special time of year and we thank all our clients for their trust. 2016 has been a very good year for our clients and the outlook for 2017 is very positive.

Zillow reports that Christmas Day, New Year’s Day and the first few weeks of January are some of the busiest online shopping days for real estate. For our seller clients, we have special programs underway so you can take advantage of these opportunities! First, we are running extensive ads on Zillow searches to attract more buyers. No other brokerage provides this level of exposure on the largest real estate website with over 65% online market share.

Our company is strategically partnering with the Zillow Group to introduce a new Zillow Video Program that will dramatically increase views for our listings. Zillow ranks listings with Zillow Videos first in their search results which provides 2X the listing views versus other listings. Buyers also save Zillow Video listings as favorites at twice the rate of other listings.

The new program will include Zillow WalkThrough videos plus options for Professional Videos on luxury listings. We are organizing strategic vendor partners to help supercharge our Zillow Video inventory. The program includes training, certifications and more to ensure the highest levels of quality. We have a dedicated Zillow Team working with us to help the program move faster. Our goal is to have Zillow Videos on the majority of our residential listings by the end of February 2017. As we move into the early spring market, our seller clients will benefit from the increased exposure to more buyers.

As the recipient of the first ever Zillow Group Broker of Excellence Award, we will continue to partner with Zillow to introduce innovative programs that benefit our clients.

The Metro Atlanta real estate market remains active during the holiday season. Here is the summary for Metro Atlanta real estate through November 2016.

- Closings for November 2016 were down 9% from last month and up 21.9% from last November. Year-to-date 2016 closings were up 10.6% compared to YTD 2015.

- The average sales price for October was $279,000 which is up 3.7% from last month and up 5.2% from last year. The Average Sales Price is on track to beat the record levels posted back in 2006.

- The listed inventory for November was down 5.4% from last month and down 3.3% from last year. But the limited availability of desirable properties is still driving multiple offers and very quick sales in select areas.

- Overall months of supply for November was 4 months. Six months is considered normal. Luxury properties are taking longer with homes above $1 million averaging 14 months and properties over $2 million averaging 33 months to close.

- The latest Case-Shiller Index (11/29/16) was up .16% from the previous month. Metro Atlanta home values are up 61% from the recent bottom of March 2012 and up 7.6% from the average index last year. Increased home values are building positive equity and getting more sellers back into the market.

- Visit HomeServices Lending at Georgia.HomeServicesLending.

com for the latest mortgage rates. The recent Fed hike has driven mortgage rates higher and many buyers are taking action before rates rise further. Our Close On Time Guarantee and Free Second Opinion programs have been very beneficial to our clients!

Click here for a more detailed set of charts including the National Real Estate Market, Metro Atlanta Real Estate Market and Trends impacting Atlanta Real Estate.

The chart below shows a summary of Metro Atlanta Home Values according to the Case-Shiller Index for Atlanta. This is an interesting perspective for general home values across Metro Atlanta. As you can see, home values have essentially recovered from the real estate recession. Local areas and price points will be different. Homes between $200,000 and $500,000 have been in high demand and may show higher gains while the luxury market may show smaller gains. Yes, real estate is truly local.

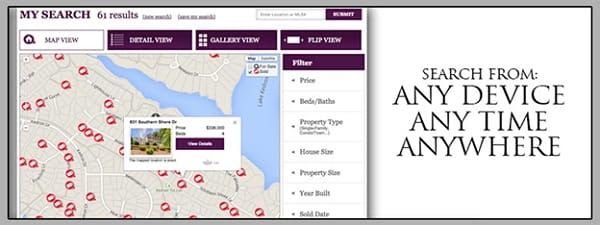

Our website provides Instant Home Values Estimates for any property in the country. You can also model changes to see the impact on the estimated value. Check out your latest estimate!

We can provide you the most accurate value estimate since we have access to proprietary information sources and local details. Contact us for more information.

| Year Property Bought | Average Gain/ Loss | Year Property Bought | Average Gain/ Loss |

| 2000 | 28.82% | 2008 | 8.43% |

| 2001 | 21.99% | 2009 | 22.67% |

| 2002 | 17.46% | 2010 | 25.73% |

| 2003 | 13.76% | 2011 | 35.20% |

| 2004 | 9.89% | 2012 | 46.59% |

| 2005 | 4.62% | 2013 | 23.89% |

| 2006 | -0.16% | 2014 | 13.35% |

| 2007 | -.80% | 2015 | 7.61% |

We would be honored to assist you or someone you know with their real estate needs. We are experts in the local market and have access to proprietary information sources that are not available to the public. Better information leads to better decisions.

Merry Christmas, Happy Hanukkah and Happy Holidays!

Lake Sidney Lanier Homes is the most comprehensive online source for information on Lake Lanier homes for sale and Lake Lanier area real estate. View the latest Lake Lanier home listings, foreclosures, lots, land, sales trends and real estate topics on Lake Lanier. Arthur Prescott is an Accredited Buyer's Representative and Certified Residential Specialist with Berkshire Hathaway HomeServices Georgia Properties. He has over a decade of Lake Lanier real estate experience. If you would like to schedule a free buyer or seller consultation, please feel free to contact us directly at www.LakeSidneyLanierHomes.com or 678-513-2014 or email us at Arthur.Prescott@BHHSGeorgia.com.